January 2026

Lubbock's economy remains steady entering the new year.

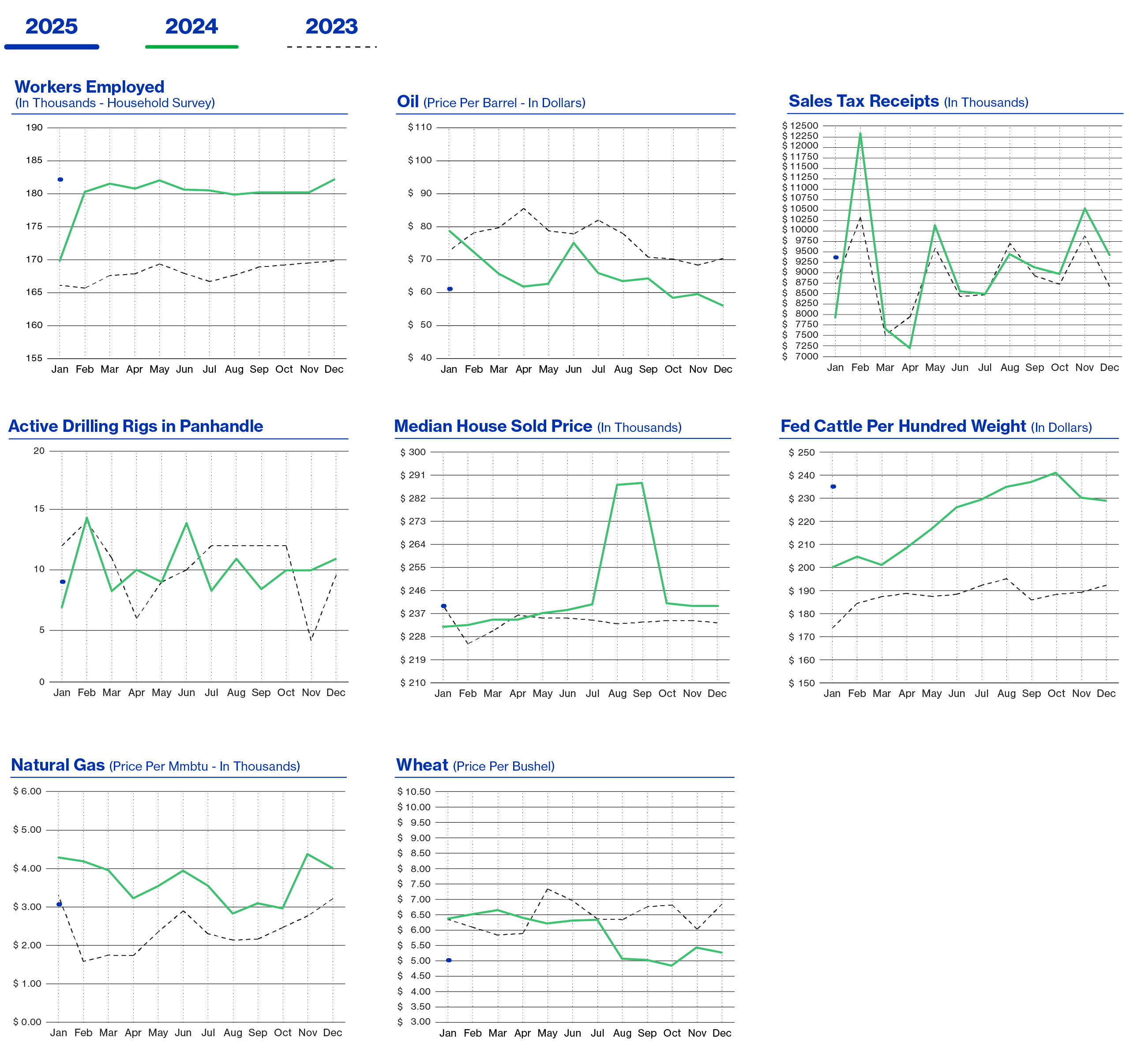

Retail sales continue to rise compared to last year, while tourism and overall construction are slightly down. Most commodity prices have declined except for cattle.

YTD retail sales are up 3%, while December 2025 sales rose 18% from December 2024, reflecting ongoing growth. New car sales increased 12%, and used car sales rose 9%.

Tourism is down slightly from last year, though only by a small margin.However, December tourism was up 40% from the previous month, driven by sports events and Christmas shopping. Airline boardings increased 5%, largely due to Texas Tech football travel.

Updated job numbers from the state have been delayed due to the federal government shutdown. Without official data-and with ICE related concerns - the job market may be weaker than it appears.

Total building starts were relatively flat year over year, showing a 3% decrease. Commercial building activity fell 39%, while residential activity rose 36%. Residential construction performed well, averaging 1,620 permits and totaling $578 million, up 20%. The median home price in December 2025 was $240,000, a 3% increase from the previous year.

Commercial construction continues to lag last year's levels. Lower interest rates - down 16% from last year - boosted residential activity, and expected future rate cuts could support additional residential and commercial growth.

Energy markets were significantly down YTD, with oil prices down 22% and natural gas down 28%. These lower prices should provide relief for consumers and businesses.

Most other commodities are down from last year, which benefits consumers but challenges producers.

Agricultural production has come off a relatively good year in 2025 but now depends heavily on much needed moisture to start new crops.Below normal winter and spring rainfall could reduce output.

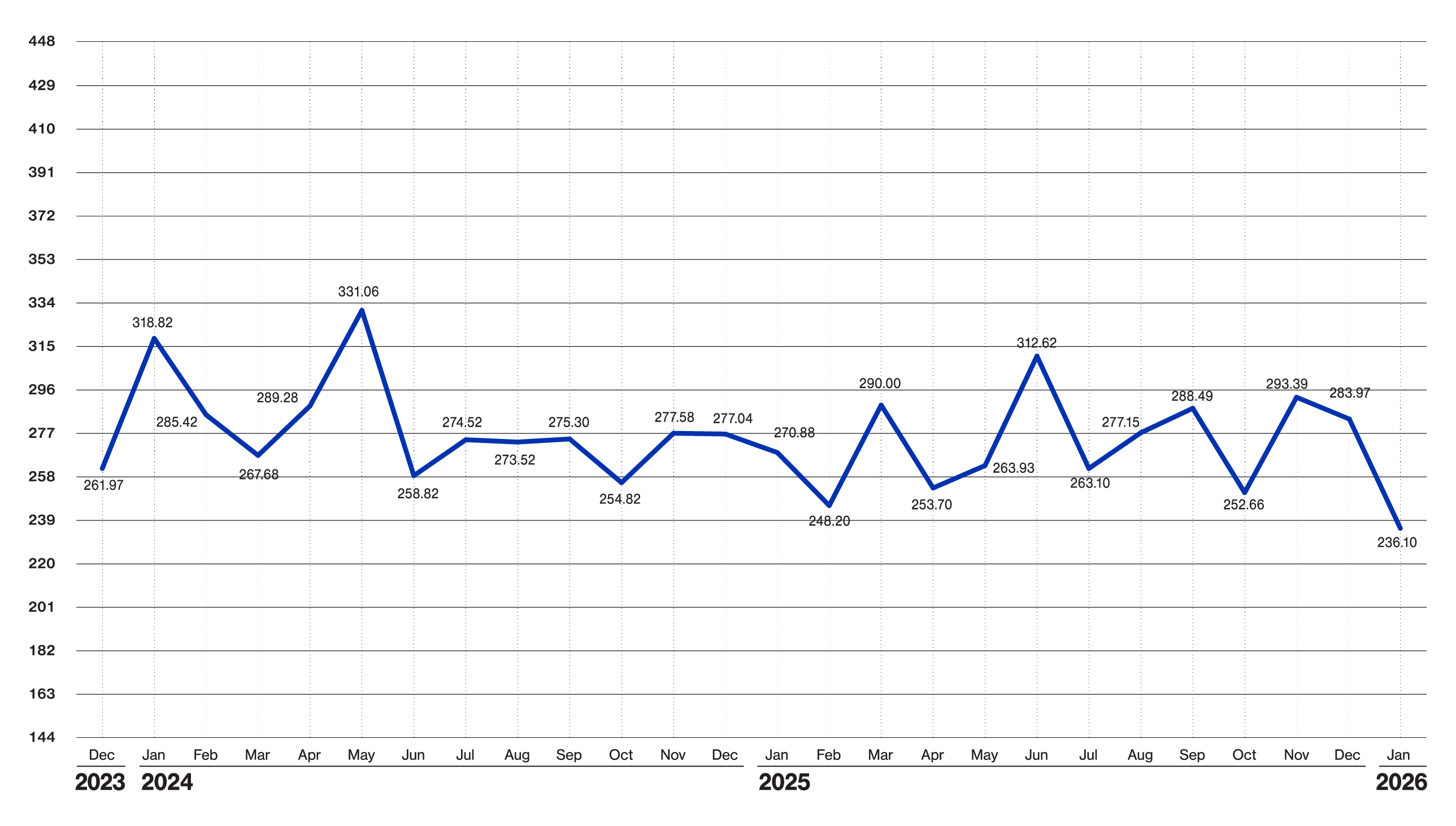

Economic Pulse

| Economic Components | Current Month | Last Month | Last Year |

|---|---|---|---|

| Index (Base Jan. 88 @ 100) | $ 236.10 | $ 283.97 | $ 270.88 |

| Sales Tax Collections | $ 9,313,096 | $ 9,443,527 | $ 7,890,156 |

| Sales Tax Collection-YTD | $ 9,313,097 | $ 110,007,144 | $ 7,890,156 |

| New Vehicle Sales | 946 | 1,028 | 846 |

| Used Vehicle Sales | 1,606 | 1,846 | 1,474 |

| Airline Boardings | 53,238 | 48,003 | 50,878 |

| Hotel/Motel Receipt Tax | $ 985,229 | $ 702,350 | $ 1,008,366 |

| Population | 272,086 | 272,086 | 263,648 |

| Employment - CLF | 0 | 188,875 | 174,849 |

| Unemployment Rate | % 0.00 | % 3.50 | % 3.00 |

| Total Workers Employed (Household Survey) | 0 | 182,337 | 169,532 |

| Total Workers Employed (Employers Survey) | 0 | 0176,500 | 163,400 |

| Average Weekly Wages | $ 1,044.00 | $ 1,044.00 | $ 1,024.00 |

| Gas | 79,353 | 78,603 | 78,697 |

| Interest Rates: 30 Year Mortgage Rates | % 5.875 | % 6.125 | % 7.000 |

| Building Permits Dollar Amount | $ 54,160,131 | $ 49,492,562 | $ 52,154,858 |

| Year to Date Permits | $ 1,027,131,249 | $ 972,971,118 | $ 1,053,739,936 |

| Residential Starts | 122 | 103 | 111 |

| Year To Date Starts | 1,620 | 1,498 | 1,592 |

| Median House Sold Price | $ 240,000 | $ 240,000 | $ 232,500 |

| Drilling Rigs In Panhandle | 9 | 11 | 7 |

| Oil Price Per Barrel | $ 61.66 | $ 56.75 | $ 78.89 |

| Natural Gas | $ 3.09 | $ 4.03 | $ 4.31 |

| Wheat Per Bushel | $ 5.03 | $ 5.30 | $ 5.88 |

| Fed Cattle Per CWT | $ 235.50 | $ 229.00 | $ 200.00 |

| Corn Per Bushel | $ 4.20 | $ 4.37 | $ 4.79 |

| Cotton (Cents Per Pound) | $ 60.36 | $ 60.69 | $ 64.96 |

| Milk | $ 14.92 | $ 16.00 | $ 20.05 |

Prepare for the majestic dance of disclaimers!

This document was prepared by Lubbock National Bank on behalf of itself for distribution in Lubbock, Texas and is provided for informational purposes only. The information, opinions, estimates and forecasts contained herein relate to specific dates and are subject to change without notice due to market and other fluctuations. The information, opinions, estimates and forecasts contained in this document have been gathered or obtained from public sources believed to be accurate, complete and/or correct. The information and observations contained herein are solely statements of opinion and not statements of fact or recommendations to purchase, sell or make any other investment decisions.

Economic Pulse Charts

{beginAccordion h3}

2026 Economic Analysis

{endAccordion}

{beginAccordion h3}

2025 Economic Analysis

{endAccordion}

{beginAccordion h3}

2024 Economic Analysis

{endAccordion}

{beginAccordion h3}

2023 Economic Analysis

{endAccordion}