Here are some frequently asked questions — and answers.

Jump to:

Credit Card Services | Electronic Check Processing | eStatements | FedNow | Health Savings Accounts | Mobile Banking | Mobile Pay | Online Banking | ID and Password Questions | Online Bill Pay | Questions About Making Payments | Same Day ACH | Travel Safety

Credit Card Services

{beginAccordion h3}

What if my card is lost or stolen?

Immediately contact Lubbock National Bank to report the loss or theft and arrange for a replacement card to be mailed to you. You should keep a copy of these numbers and your account number in a convenient place-separate from your card.

Lubbock National Bank

(806) 378-8100

Mon-Thur: 8:00am - 5:00pm

Fri: 8:00am - 6:00pm

Sat: 9:00am - 12:00pm

(855) 207-7134 after business hours

What to do if you find a mistake on your statement?

If you think there is an error on your statement, write to us at:

Lubbock National Bank

Attn: Credit Card Dept.

410 S. Taylor

Amarillo TX, 79101

You must write to us no later than 60 days after you received the first statement on which the alleged error appeared. We must acknowledge your letter within 30 days unless we have corrected the alleged error by then. Within 90 days, we must correct the alleged error or explain why we think the billing statement was correct. You do not have to pay the amount in question while it is investigated, but you must continue to make payments on the rest of your outstanding balance. Please see your cardholder agreement for details.

How do I make a payment on my LNB credit card?

It's simple! You can pay your LNB credit card at your convenience:

Online:

Personal at https://onlinebanking.firstdata.com/ecs/amarillo-national-bank

Business at https://spendtrack.fiservapp.com/amarillo-national-bank/

In Branch:

At any full-service LNB branch location

By mail:

Lubbock National Bank

Attn: Credit Card Dept.

410 S. Taylor

Amarillo TX, 79101

Do I have to be a resident of the United States to apply for the Lubbock National Bank credit card?

Yes.

How old do I have to be to apply for the Lubbock National Bank credit card?

You must be 18 years or older.

How can I register my Lubbock National Bank credit card account?

Registration is easy:

Simply go to https://onlineaccessplus.com/anb/.

Click on the Register Here button located on the right and follow the easy steps to register.

How long will it take to receive my Lubbock National Bank card?

Upon approval, you will receive your new LNB visa within 7-10 business days, along with your cardholder agreement explaining the features, benefits and details pertaining to the use of your Lubbock National Bank credit card.

Is Credit Card Account Access free?

Yes, Credit Card Account Access is absolutely free to you as an Lubbock National Bank cardholder.

What can I do through the Credit Card Account Access service?

You will have instant access to your account information online. Specific features include:

Account Summary — View your current account balance, available credit, minimum payment due, payment due date and last payment amount.

Recent Activity — See all transactions posted to your account since your last statement.

Dispute an Item — Simply click on the customer service tab and select file a dispute. Select the dispute type and fill in the transaction details pertaining to the questionable charge.

View Statement Information — View, print and save up to 2 years of Statements.

Manage My Profile — Use this simple tool to change your password, email address, user name and much more.

How can I make payments online?

Once your account is registered, you can log into https://onlineaccessplus.com/anb/ and select the Payments option. You may make a payment on your credit card account now using your checking or savings account. Payments made prior to 3 p.m. Central Standard Time will be posted to your credit account on that day. Payments made after 3 p.m. Central Standard Time will post to your account the next business day.

You can also pay your LNB visa conveniently through our Online Bill Pay

Are there late payment fees?

If your payment is not received by the due date, you may be charged a late fee. Please refer to your Lubbock National Bank card agreement for more information.

Will my rate change if I miss a payment?

According to your Lubbock National Bank card agreement, if you are in default on any Lubbock National Bank credit card, Lubbock National Bank may increase the rate on the entire balance to a “delinquency” rate. This “delinquency” rate will apply to all outstanding debt and new balances.

{endAccordion}

Electronic Check Processing

{beginAccordion h3}

Is electronic check processing secure?

Electronic check processing is not new to the financial industry and is a safe and reliable way of processing payments. It uses technology that has been developed and tested to process your check information securely.

Does electronic processing make my checks clear faster?

As technology and bank operations continue to streamline, check-processing speeds will continue to increase. This means money may be deducted from your checking account faster. Before you write a check, it's always best to make sure your account contains enough money to cover the check.

Can I still get my checks back with my account statements?

Yes. However, you may receive a mixture of canceled original and substitute checks (a printout of an electronic picture of the original check, plus payment information used by the banks). If you receive image statements (pictures of several checks on a single page), you also may notice that some of the pictures are of substitute checks.

Does electronic check processing mean my deposited checks will be available for withdrawal faster?

A federal law (the Expedited Funds Availability Act) specifies the maximum amount of time your bank has to make funds available to you — but most banks (including LNB) make funds available faster than required.

This law requires the Federal Reserve Board to reduce maximum hold times in step with reductions in actual check-processing times. Therefore, as check processing gets faster over time, the Board will reduce maximum hold times.

NOTE: If the bank decides to place a hold on funds that you have deposited by check, this does not affect your interest. Specifically, if you deposit a check into an interest-bearing checking account, we are generally required to begin crediting interest to your account no later than the business day on which the bank receives credit for the funds.

What is Check 21 and what is its basic purpose?

Check 21 is a federal law enabling banks to handle more checks electronically, which should make check processing faster and more efficient. Instead of physically moving most original paper checks from bank to bank, Check 21 allows banks to process more checks electronically.

Banks can capture a picture of the front and back of the check, along with the associated payment information, and transmit this information electronically. If a receiving bank or its customer requires a paper check, the bank can use the electronic picture and payment information to create a paper "substitute check." This process enables banks to reduce the cost of physically handling and transporting original paper checks, which can be very expensive.

What is the difference between Check 21 and programs that convert checks to electronic payments?

A check you write may be processed as a regular check. In that case, your rights are governed by check laws and regulations. Some merchants, however, may use your check as a source of information to create what's called an "electronic fund transfer." (You must receive notice that your check may be processed this way.)

Electronic fund transfers are governed by different laws and have different consumer rights than check payments. For more information, see the brochure "When Is Your Check Not a Check: Electronic Check Conversion" published by the Federal Reserve Board.

{endAccordion}

eStatements

{beginAccordion h3}

Are eStatements Secure?

Most identity theft occurs when snail-mail is intercepted or paper information is improperly discarded. That's why identity theft experts recommend eStatements over paper statements— they keep your personal data much more secure. Ours are protected by the state-of-the-art security of LNB Online Banking.

How do eStatements work?

- Each month, LNB will send you an e-mail notification as soon as your bank statement is available online.

- You can review your most current statement anytime, simply by logging onto LNB Online Banking.

- You can also review images of all checks that have cleared your account to date.

- Your eStatement can even be printed or saved to your computer for your permanent records.

- You can now view your statements through the LNB Digital Banking app.

Read our eStatement agreement.

{endAccordion}

FedNow

{beginAccordion h3}

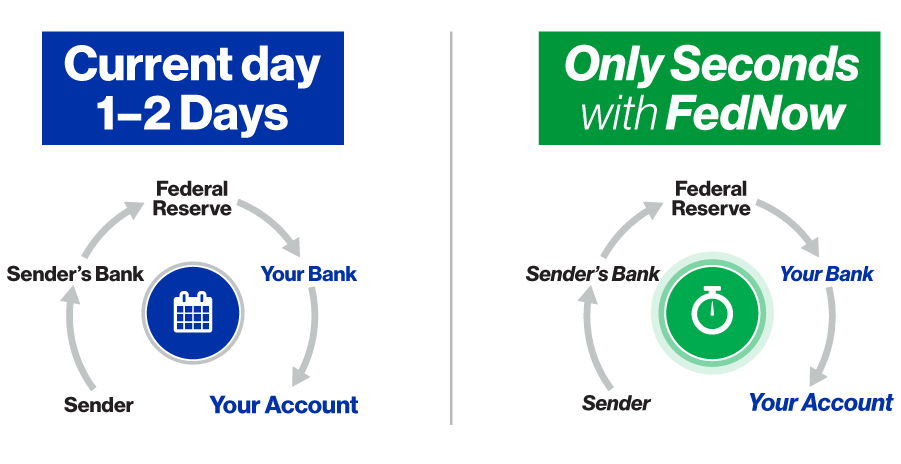

What is FedNow

FedNow will allow you to transfer money faster 24/7/365!

Federal Reserve has always played a role in providing payment services.

The Federal Reserve has ALWAYS played a role in providing payment services, processing transfers like recurring bill payments, and direct payroll deposits.

Federal Reserve Banks are working to roll out an innovative instant payment platform called FedNow, that allows financial institutions to provide safe, instant payment services, 24/7/365 (yep, even on holidays and weekends!). FedNow will give businesses and individuals the ability to send and receive real-time payments. Funds will be available instantly so the recipient can manage their money more efficiently.

Will LNB take part in FedNow?

Lubbock National Bank is currently reviewing the new FedNow system and its capabilities. We do plan to offer support for FedNow and real time payments in early 2024

Does the Fed have access to my bank account with the FedNow Service?

Nope! The Federal Reserve and the FedNow Service cannot access individuals’ bank accounts or control how they choose to spend their money. FedNow is only offered to banks and credit unions to transfer funds for their customers.

{endAccordion}

Health Savings Accounts

{beginAccordion h3}

What are the benefits of a Health Savings Account (HSA)?

Health Savings Accounts can provide significant tax benefits to eligible individuals. Not only can HSAs provide tax benefits related to paying qualified medical expenses. they may also provide benefits similar to many tax-favored retirement plans. including

HSA contributions — by employer or employee — are excluded from income.

HSA earnings are tax-deferred.

If used for qualified medical expenses, HSA assets are never taxed.

Unused HSA assets may be used for retirement; however, effective 1-1-2011 they will be subject to a 20 percent penalty until the HSA account beneficiary turns age 65. If not used for medical expenses, they will be subject to income taxes.

Upon death, HSA assets become property of a named death beneficiary, or of the HSA account beneficiary's estate. A spouse may treat the assets as his or her own HSA, while non-spouse death beneficiaries must treat such assets as ordinary taxable income.

A spouse may treat the assets as his or her own HSA, while non-spouse death beneficiaries must treat such assets as ordinary taxable income.

Your employer may designate a group set-up at LNB for all employee HSAs, helping streamline the contribution process for both you and your HR department.

Content — ©2011 BISYS Retirement Services

What are qualified medical expenses?

For HSA assets to retain their tax-free status, they may only be withdrawn and used for certain expenses, including:

- Actual medical expenses, such as doctor visits, prescriptions, and transportation to get medical and dental care

- Long-term care insurance

- Health care coverage when unemployed

- Certain continuation-of-benefit health care coverage

- Certain health insurance after age 65

- Non-qualified uses of HSA assets are subject to taxation and a 20 percent penalty unless the HSA account beneficiary is age 65 or older, dies, or is disabled.

Content — ©2011 BISYS Retirement Services

Who is eligible to participate?

You are an eligible individual for any month if you:

- Are covered under a high-deductible health plan

- Are not also covered by any other health plan that is not a high-deductible health plan (with limited exceptions)

- Are not enrolled for benefits under Medicare (generally not yet age 65)

- Are not eligible to be claimed as a dependent on another person's tax return

Content — ©2011 BISYS Retirement Services

Can self-employed individuals have an HSA?

Sole proprietors and others who are self-employed can have a Health Savings Account. In fact, they're often ideal candidates for an HSA. In such situations, the business owner is both employer and employee.

HSAs are often advantageous for the self-employed because:

- High-deductible health insurance plans generally have modest premium costs, and may be an effective

cost-containment mechanism for the employer. - The employer is protected against potentially catastrophic health care expenses.

- The HSA may serve the dual purpose of providing for both medical and retirement expenses.

Content — ©2011 BISYS Retirement Services

What are the HSA contribution rules?

The total amount you or your employer may contribute to an HSA for any taxable year is dependent upon whether you have individual or family coverage under a high-deductible health plan as shown in the table below.

What is considered a high-deductible health plan?

A high-deductible health plan (or HDHP) is an insurance policy that meets certain dollar limits as shown in the table below.

2017 HSA Cost of Living Adjustments

|

Year |

HSA Annual Contribution Limit |

HDHP Minimum Annual Deductible |

HDHP Maximum Out-of-Pocket Expense |

|---|---|---|---|

|

2017 |

$3,400 self-only |

$1,300 self-only |

$6,500 self-only |

|

2018 |

$3,450 self-only |

$1,350 self-only |

$6,650 self-only |

*HDHP and contribution limitations are revised each year to reflect cost-of-living increases.

Content — ©2011 BISYS Retirement Services

Do HSAs require reporting?

HSAs require the following government reporting:

- HSA holders must report all contributions and distributions on their individual income tax returns.

- An employer contribution is reported on a business tax return, as well as on the W-2 form of any employee receiving an employer contribution.

- All contributions and distributions from an HSA account are also reported by the custodian or trustee where the HSA is held.

Content — ©2011 BISYS Retirement Services

What are the service fees for an HSA?

There is a $5 one-time set-up fee and a $3 monthly service fee.

{endAccordion}

Mobile Banking

{beginAccordion h3}

How do I set up Mobile Banking on my phone?

- Go to the app store/play store.

- Search "Lubbock National Bank" and download the app.

- Enter your login ID and password.

- Select a contact method for your secure access code.

- Register your device.

Once I request to be signed up, how long before I can begin using the service

You can get started immediately.

Which phones/mobile devices are currently supported?

Q2mobility App requirements

This section describes the operating systems, connection types, and camera resolutions that are compatible with Q2mobility Apps. End users can download the app from the Apple Store (for iOS devices) or Google Play (for Android devices).

Note the following details about Q2mobility Apps:

A valid email address and telephone number are required.

Q2mobility Apps function best when the GPS or native mapping app (also called Location Services) is enabled.

When requesting customer support for Q2mobility Apps, identify the model and operating system of the device and, if applicable, confirm that the camera is rear-facing.

To deposit checks with Mobile Remote Deposit Capture (mRDC) in Q2mobility Apps, an end user must have a mobile device with a rear-facing camera with a resolution of at least 5 megapixels.

|

The following table provides Android OS requirements for Q2mobility Apps:Supported Android OS versionsVersion |

UUX 4.x |

|

|

Android 8.x and later |

Supported |

|

|

Version |

UUX 4.x |

|

|

iOS 15.x and later |

Supported |

|

|

iOS 14.x and later |

Limited support |

|

You should be able to access LNB Mobile Banking with any mobile device (phone, PDA or Palm®) that has Internet capability. If you are unsure of your phone’s capabilities, please contact your wireless provider. Please note: Although LNB does not charge for Mobile Banking, your wireless carrier's standard Web access rates do apply.

What type of transactions can I complete?

All Online Banking functionality is available through the app. You can also do mobile check deposits.

Can I transfer funds between any of my accounts?

You can complete transfers to and from your LNB checking and savings accounts.

Can I pay bills using Mobile Banking?

Yes! You can pay bills from absolutely anywhere with mobile banking.

Is there a daily cut-off time to complete transactions on the current business day?

Yes: 7 p.m. Central time.

What is the charge for using Mobile Banking?

ANB does not charge for mobile banking access; however, data and messaging rates may apply.

Where can I get help with understanding and using Mobile Banking?

Call 806-378-8213 or 1-800-ANB-FREE (1-800-262-3733).

How do I know my personal information is secure with Mobile Banking?

Your personal information is protected by advanced encryption technology to prevent unauthorized access.

We use your phone number to automatically verify your identity along with a password and authentication image.

What is a secure access code?

A secure access code is part of our upgraded security features. The system will require that you receive a secure access code to verify your identity by confirming that your contact information matches what is currently in our system.

What if my correct phone number is not an option when I am requesting my secure access code?

Contact the Digital Banking Department at (806)378-8213 or 1-800-ANB-FREE (1-800-262-3733) and we will be happy to assist you with confirming your secure access code and updating your contact information.

How can I request another secure access code?

If your secure access code has expired, you can simply attempt to login to the system again and it will give you the option to request another secure access code. If you are still having trouble getting into the system, please contact the Digital Banking Department at (806)378-8213 or 1-800-ANB-FREE (1-800-262-3733).

Will I have to have a secure access code each time I log in?

Each time you login to a new device you will be prompted for a secure access code. If you are using a personal device, you can select to register the device to prevent the system from requiring the secure access code in the future.

I do not have a cell phone. Do I need one to use online banking?

You do not need a cell phone to use online banking. You are able to access our full website by logging in to www.LubbockNational.com.

What if I don’t have a cell phone and do not use email?

You do not need a cell phone to use online banking. However, you will need a valid e-mail address to register for online banking.

Are the Access ID and Password case sensitive?

The Access ID is not case sensitive; the Password is case sensitive.

What are the password requirements?

- Must be a minimum of 8 characters and a maximum of 24 characters

- Must contain at least one letter, one number, and one special character

- Cannot be the same as the last password used

In addition to the requirements listed above, business customers will also be required to change their password every 180 days. Retail customers will not be required to change their password unless they are impacted by fraud.

What if I do not see all of my accounts after I login?

Please contact Lubbock National Bank’s Digital Banking Department at (806)378-8213 or 1-800-ANB-FREE (1-800-262-3733) for assistance with linking a missing account.

When using the Pay a Person feature, why do the numbers change on the pin pad when I am entering my PIN number?

This is actually an extra security feature to prevent anyone who may be able to view your screen or any monitoring software that may be on your device from getting your PIN number.

What is the difference between Adding an External Account and Linking an Account?

Adding an external account will allow you to transfer money to and from that account using your online banking. Linking an account will allow you to use LNB’s online banking system to view balance and history information for accounts held at other financial institutions.

The option to add an external account for transfers must be requested. To make that request please call us at (806)378-8213 or 1-800-ANB-FREE (1-800-262-3733).

How do I add an external account for transfers?

You will need to login to your online banking and navigate to “Add External Account” which is located in the Transfers & Payments menu. From this screen you will need to enter the routing number and account number of your account at another bank. We will then send 2 small deposits to your account with that bank, once you have received them you will again login to your online banking and this time navigate to “Verify External Account” in the Transactions & Payments Menu. Enter the amount of the 2 small deposits that you received and you will then be given access to transfer to/from that account within your online banking.

How do I link an external account to view balance and transaction history?

From the main page, click on “Link Account” in the next screen you will search for the financial institution where your other account is held. Enter your login information for that institution and click “Continue.” The system will then validate your login information (this may take a few minutes). After the linking is complete, you will see an option that says “Select Accounts”, you can click on this option and the next screen will allow you to select which accounts you would like to view on your homepage.

*The Link Account option will not allow you to transfer between accounts. You will only be able to view the accounts. See above for the difference between linking an account and adding an external account.

Why do the colors change on the Asset Summary graph?

The colors that are assigned to each account are random and may change each time you login to your online banking. Unfortunately, we do not have the ability to change this setting currently.

If you have further questions, please contact Lubbock National Bank’s Digital Banking Department at (806)378-8213 or 1-800-ANB-FREE (1-800-262-3733) Monday – Friday from 8:00 AM until 5:00 PM.

{endAccordion}

Mobile Pay

{beginAccordion h3}

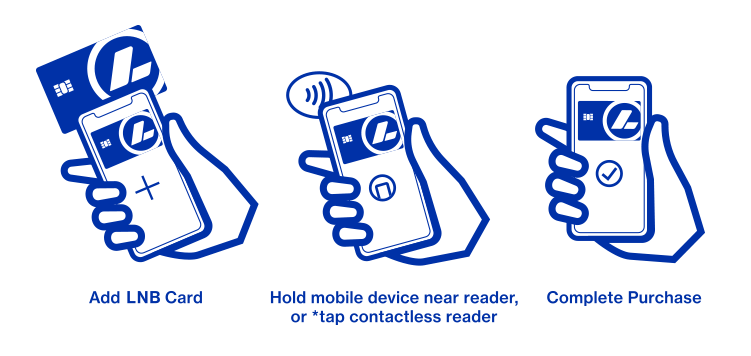

Apple Pay™, Samsung Pay™, and Google Pay™

Now, whether you are paying in a store or within apps, you can pay with your supported mobile device.

How to Pay

To pay, just hold your mobile device near, or *tap the contactless reader. A subtle vibration and beep will let you know your payment was successfully sent.

Where to Pay

You can pay anywhere Apple Pay, Samsung Pay, and Google Pay contactless payments are accepted. To see a full list of devices that are eligible for each of these mobile pay providers click links below.

Look for one of these symbols at checkout.

More Information

Learn more about mobile pay at the following links:

Apple Pay: https://www.apple.com/apple-pay/

Samsung Pay: https://www.samsung.com/us/samsung-pay/

Google Pay: http://pay.google.com/about/

*Google Pay Only.

{endAccordion}

Online Banking

{beginAccordion h3}

How can I protect myself from cyber threats?

Check out our Top 12 Cyber Security Tips.

Do I have to be an Lubbock National Bank customer to use Online Banking?

Yes, you must have at least one Lubbock National Bank account to use our online banking services.

Can I make a payment to a personal loan if I don't have checking or savings account with Lubbock National Bank?

Yes, you can make a personal loan payment without having an Lubbock National Bank checking or savings account. Simply click here. However, if you do have an Lubbock National Bank checking or savings account please pay you loan by logging in here.

How do I sign up for Online Banking?

The easy on-screen directions will walk you step-by-step through the sign-up process and provide you with access to your account(s) with Lubbock National Bank, immediately after online forms are complete.

Once I finish enrolling for Online Banking, how long before I can begin using the service?

Your accounts will be activated immediately after all the sign up steps are complete and you may begin using Online Banking. Simply enter your username and password to access your accounts — if you are unable to access you account(s) online please contact us at (806) 378-8213 during normal business hours for assistance.

What are the system and browser requirements to access Online Banking?

System requirements

You must use a computer that has:

Microsoft Windows 10 or later or Mac OS X 10.10 or later.

Available browser updates applied for improved security that provide anti-virus and spyware protection.

An internet connection with a minimum of 1 Mbps download speed.

Satellite connections often have difficulty supporting Hypertext Transfer Protocol Secure (HTTPS) applications. Since Q2online is HTTPS-encrypted for the safety of your financial information, some satellite cable connections may exhibit slow responses.

Display requirements

Prior to version 4.4.0, desktop and laptop displays could be any height but needed to be at least a 1280-pixel width. Otherwise, the end user may need to scroll horizontally to see the entire Q2online user interface. However, beginning with version 4.4.0, users can view most pages without horizontal scrolling.

Browser requirements

Browser support is subject to change without notice, so we encourage end users to configure browsers for automatic updates. Use the latest version of your browser for the most secure experience in Q2online.

Compatibility mode and document mode settings in browsers are not supported by UUX. If configured, an Unsupported Browser page appears when a user attempts to log in through a browser with one of these modes set.

Q2 can send advance notice to end users accessing online banking through a browser for which support has been scheduled to end. The notice times are configurable. Contact Q2 support for more information.l Note: Note:

|

Any browser not listed in the following table should be considered unsupported by Q2.Browser |

Windows |

macOS |

|

Google Chrome (Current and previous two major versions) |

Recommended |

Recommended |

|

Mozilla Firefox (Current and previous two major versions) |

Supported |

Supported |

|

Microsoft Edge (Current and previous two major versions) |

Supported |

Unsupported |

|

Apple Safari (Current and previous two major versions) |

Unsupported |

Supported |

|

Any browser not listed in the following table should be considered unsupported by Q2.Browser |

Windows |

macOS |

|

Google Chrome (Current and previous two major versions) |

Recommended |

Recommended |

|

Mozilla Firefox (Current and previous two major versions) |

Supported |

Supported |

|

Microsoft Edge (Current and previous two major versions) |

Supported |

Unsupported |

|

Apple Safari (Current and previous two major versions) |

Unsupported |

Supported |

What type of transactions can I complete using Online Banking?

You can review and print transaction statements or monthly account statements, pay your bills and transfer funds between accounts. You can also select, sort and export transactions to personal financial management applications such as Microsoft® Money and Quicken®.

If you have LNB CDs and/or loans, you can even check your statements, balances and make loan payments via Online Banking (although you cannot transfer funds directly to CD accounts).

Can I download transactions to my software such as Quicken™, Microsoft Money™ or Microsoft Excel™?

It's easy to download transactions using the Export Feature in your Online Banking Account. Enter the account you wish to Export transactions from, use the transactions button to download up to 2 months of past transaction history. If you require more than 2 months of transaction history, please use the All Transactions button. This will allow you to pull up to 16 months of transaction history. You will be prompted to select the format you wish to use.

- .CSV - Comma Separated - Microsoft Excel.

- .QIF - Quicken.

- .QFX - Quicken version 2003 or later.

- .QBO - Quickbooks version 2003 or later.

- .OFX - Money.

Is there a daily cut–off time to complete transactions on the current business day?

Yes. Transactions completed via Online Banking on weekdays (Monday–Friday) before 7 p.m. will post to your account the same day. Transactions completed after 7 p.m. or on weekends will post to your account the next business day.

What is the charge for using Online Banking?

Online Banking is a free service provided to Lubbock National Bank customers.

Where can I get help with understanding and using Online Banking?

If you are needing help with Online Banking, please contact us at (806) 378-8213.

How do I change the viewing screen size of my monitor?

The optimal viewing size (screen resolution) for Online Banking is 800 x 600. Changing your screen resolution may help make Online Banking easier to use, but keep in mind that it will change the viewing size for all applications.

For PC users:

- Click on the Start button on the main Microsoft® Windows® screen.

- Go to Settings, then open the Control Panel.

- Select Display, then click on Settings.

- From there, change your screen size to 800 x 600.

For Mac users:

- Open System Preferences and click Displays. This will show you the preferences for your display and color settings.

- Click the Display tab, and change your screen size to 800 x 600.

How do I enlarge the size of the text as it appears on my screen?

You may change the size of the text by selecting View in the main header bar, then Text Size and selecting the size you prefer. Note: Changing the viewing screen size of your monitor will also enlarge the text appearance.

{endAccordion}

ID and Password questions

{beginAccordion h3}

For a new account, what do I enter in the Access ID and Password box (on the login screen)?

To login you must first set up online access by going to www.LubbockNational.com and selecting set up online access on the home page. When you open the account, you will set up a username and password for your account login. Your username must be at least 6 characters and your password must:

- Be a minimum of 8 characters and a maximum of 24 characters

- Contain at least one letter, one number, and one special character

- Cannot be the same as the last password used

The password is case sensitive, which means that upper and lower case characters should be typed as they appear.

How do I change my password?

To change your password, select settings on the lefthand menu and then select security preferences. Select the change password box, complete the required fields and the click change password button.

What do I do if I forget my password?

You will need to set up a new password. Use the "Forgot Password" link in the login area. Contact us at (806) 378-8213 or speak with a Customer Service Representative during your next bank visit.

What happens if I incorrectly enter my login information?

If you enter your username or password incorrectly three consecutive times, you will be locked out of online banking for 24 hours. However, if you are locked out three consecutive times, your online profile will need to be unlocked by a Digital Banking Representative. Please note that at this point, the "Forgot Password" link will not unlock your account. This is one part of our comprehensive security to ensure confidentiality. To gain access again or to receive a temporary password, contact us by phone at (806) 378-8213 or stop by any of our branches.

Which accounts will I be able to view through Online Banking?

You may view any LNB checking, savings, credit card, CD or loan account on which you are an authorized signer.

Can I find out CD information (such as the maturity date) via Online Banking?

Yes, you can use Online Banking to find out the following information on any LNB CDs you own. When you click on your CD from the home page, select the details tab to view this information.

- Maturity date

- Balance

- Interest received

- Interest rate

- Transaction activity

Can I find out loan information (such as the loan rate) via Online Banking?

Yes, you can use Online Banking to find out the following information on any of your LNB loans. When you click on your loan from the home page, select the details tab to view this information.

- Loan rate

- Payment amounts

- Due dates

- Interest paid

- Principal balance

- Estimated Payoff information

- Loan and maturity date

How do I add accounts for viewing on Online Banking?

When you open a new LNB account, our Online Banking system will automatically add your account to your online profile. However, if you have two accounts under slightly different names (for example, "Kimberly Smith" and "Kim Smith") our system might consider those two different account-holders.

In that instance, you can call a customer service representative and we can modify the system to recognize both accounts as yours. If you are not able to view all of your accounts on Online Banking, please contact us by phone at (806) 378-8213 or visit the nearest branch location.

What screens can I print from Online Banking?

You may print any screen that appears within the Lubbock National Bank website. Per your browsers printing options.

Does the balance shown on the Accounts Summary page include all transactions that have posted to my account?

For Checking and Savings information, all transactions that have been presented to the account (including those presented today) are included in the available balance.

Will Online Banking display transactions that will overdraw the account and/or be considered NSF (non-sufficient funds) transactions?

Yes, the transactions will be displayed on Online Banking — items that attempt to pay outside the overdraft limit will show pending. These items won't post and therefore you won't be able to view the transaction in your transaction history. (This includes instances where a deposit is being held because funds are not available to pay the item.)

Can I transfer funds between any of my accounts?

Yes, you may complete transfers to and from checking and savings accounts and make payments to loans.

Can I transfer funds between LNB and another bank?

Yes. To add an external account please contact us at 806-378-8213 to request this feature. You will need to verify the external account before transfers can be made.

How do I request a transfer of funds between accounts?

For Transfers:

- Select Transfers & Payments on the lefthand menu.

- Select Transfer My Funds

- Select the From Account and the To Account.

- Enter the amount.

- Select the Frequency and the Transfer Date.

- Enter a memo (optional).

- Click Transfer Funds.

To make a quick transfer while working within an account:

- Select the Quick Transfer Icon

- Select the From Account and the To Account.

- Enter the amount.

- Click Transfer Funds

- *Please note, this option will default to the account you are working on being the receiving account. If you change the TO Account, you can then select it as the FROM Account.

If you have any questions regarding the transfers please contact us at (806) 378-8213.

{endAccordion}

Online Bill Pay

{beginAccordion h3}

What is the cost for using Online Bill Pay?

Online Bill Pay is free for all Lubbock National Bank checking account customers.

How do I start using Bill Pay?

You can enroll in Bill Pay by selecting "Pay Bills" on the lefthand menu. Select the account you want to use for Bill Pay and then accept the terms and conditions. You can then start to add merchants/payees and begin making payments.

How do I add a Merchant/Payee to my list?

Select Add Company or Person and then complete the requested fields.

How do I change the account number or address for a Merchant/Payee?

To change the account number, select the Merchant/Payee in the payment center. You will see an option that says change. Follow the prompts to change the number.

{endAccordion}

Questions about making payments

{beginAccordion h3}

What type of bill payments are available?

There are two types — one-time and recurring. Payments can be sent out electronically, as a single check, or a draft check. Reoccurring payments are set to pay the same day every month. For more information on how payments are sent, please contact us at (806) 378-8213.

Do I have to re-enter payments each month?

If you make the same payment amount to a certain Merchant/Payee each month, you can set up automatic payments to send that same amount monthly. If the payment amount changes, you will need to create a new payment each time.

What is the maximum amount for any one payment?

Yes. If you plan to make a large payment, please call us at (806) 378-8213.

How far in advance can I set up a payment?

Payments can be set up as much as 12 months in advance.

Are there any payments I should not make through the system?

The following payment types should not be made through the system:

- Tax payments

- Court-ordered payments

- Payments to payees outside the United States

What if my payment falls on a non-business day?

One-time payments cannot be scheduled for non-business days (such as weekends or federal holidays).

If an automatic/recurring payment date falls on a non-business day, the payment is processed on the preceding business day.

Can I cancel or change a scheduled payment for today?

For cancellation options, please contact us at (806) 378-8213.

How will I know if a payment was processed successfully?

The Payment Activity Page will show a status of "Processed" for that particular payment. However, this does not guarantee the Merchant/Payee received or posted this payment

Is there a way I can verify online that a Merchant/Payee received my payment?

Actual verification needs to come from the Merchant/Payee.

If payment was made to the Merchant/Payee by check, you can determine if the check has been cashed by viewing the payment details under payment history.

If the payment was made via electronic means, you must contact the Merchant/Payee to verify that the payment was received and posted.

What do I need to do if one of my Merchants/Payees notifies me that a payment has not been received?

First, contact the Merchant/Payee directly to verify that the payment has not been received. Next, use the Payment History menu to confirm that your payment was processed from LubbockNational.com. View the payment details and select Payment Inquiry to initiate a Payment Investigation.

Why do I get a confirmation number when I make a payment?

Confirmation numbers are provided for all confirmed or modified payments. This is your assurance that a payment has been scheduled. It is also a reference number that can be used for requesting research.

The payment history showed that my payment was processed, but my account has not been debited.

Please contact us at (806) 378-8213.

Is there a way to see my previous payments?

Payment history is retained for up to 7 years. You may search for past payments by using the Payment Activity page. You can enter the date range and then filter by the following:

- Recipient Name

- Category

- Status

- Account

Online Banking Troubleshooting Tips

If you are unable to log in to online banking here are a few troubleshooting tips to help you out.

Steps to checks

If you are still experiencing problems at this point, gather the following information and contact Lubbock National Bank customer support at (806) 378-8213 or 1-800-ANB-FREE (1-800-262-3733)

{endAccordion}

Same Day ACH

{beginAccordion h3}

What is Same Day ACH?

Currently, ACH payments are settled on the next business day. With Same Day ACH payments will be settled on the day they are submitted as long as the effective date determines so. Additional changes related to Same Day processing are outlined below.

What types of ACH payments are eligible for Same Day processing?

According to NACHA, 99% of ACH transactions are eligible for Same Day processing. Only international transactions (IATs) and transactions above $1,000,000 are not eligible.

Will the current ACH processing schedule change?

No, Lubbock National Bank’s 5:00pm deadline will still be in place. Two new Same Day ACH deadlines will now exist; 9:00am with settlement occurring by 12:00pm, 1:15pm with a settlement occurring by 4:00pm, and 3:15pm with a settlement occurring by 5:00pm.

Is there an additional fee for originating Same Day ACH payments?

Yes, as this is a premium service, there is a different pricing schedule for Same Day ACH origination. Fees are $1.00 per transaction in addition to a $25.00 monthly fee.

How do I sign up for Same Day ACH?

Same Day ACH will be available to all ACH clients. Simply select today's date when initiating an ACH file within Online Banking.

Is the over $1,000,000 value limit applied to a single item or to a file?

The transaction limit of $1,000,000 applies to a single item, not a file. In addition, transactions may not be restructured or split to evade the $1,000,000 limit. For example, if a business has a loan payment of $1,050,000 due, that payment would not be eligible for Same Day ACH and should not be divided and sent as multiple Same Day entries in order to avoid the per-transaction dollar limit. Dividing a higher-value payment into separate transactions to get around this limit is an ACH rules violation.

What happens if a file submitted for Same Day settlement contains one or more item(s) over $1,000,000?

All items in the file will be processed, and the item(s) over $1,000,000 will be assigned the next business day’s settlement date, whereas the remaining items will receive Same Day settlement.

If I send a Same Day ACH payment for processing, when will my account be debited or credited for the ACH file?

If you originate a Same Day ACH Credit or Debit, your account will be debited or credited the Same Day you originate the transaction.

How important is the effective entry date?

With Same Day ACH, the effective entry date in your file is critical. Assuming the file is submitted by the appropriate deadline, it is the effective entry date field that triggers Same Day settlement for eligible transactions. The current processing day in the effective entry date field, is interpreted as an intentional indication of the desire for Same Day settlement whether the effective entry date field contains the current processing date, or is invalid or stale.

NOTE: Items that settle before the recipient expects them are eligible to be returned as “unauthorized.” The originator is then required to obtain a new signed authorization to originate future transactions

How can I ensure items not intended for Same Day settlement are processed properly?

You should include a future date in the effective entry field to ensure future day settlement. ACH files created with today’s date and sent before 3:15pm CT may be processed as a Same Day ACH files, and applicable fees will apply

How do I change the effective entry date on my file?

If you use software to create a NACHA formatted ACH file, work with your provider to ensure the software applies the effective date either Same Day or Future Day depending on when you want your ACH files to process

If you use Business Online Banking to create a NACHA formatted ACH file, the system is ready. If you would like to originate Same Day ACH files, simply select the Same Day option when initiating a file.

What will happen if I continue to send Same Day or stale dated files and have no intention of sending Same Day ACH?

If your file is received prior to 3:15pm CST and has an effective date as the Same Day, it could be processed Same Day and you will be charged Same Day ACH fees. If you continue to send Same Day or stale dated files, you will be opted in for Same Day ACH so your files will process normally as Same Day ACH files

If I receive a Same Day ACH Credit or Debit, when will I see it in my account and how will I know it was a Same Day ACH?

Same Day ACH Credits and debits received to your account will post by the end of the bank’s posting day. You may see the transaction as pending in your account as soon as it is received by the Receiving Depository Financial Institution (RDFI). The transaction will post to your account with the same type of transaction description and details as the ACH Credits and Debits that currently post to your account today

What happens if I send a Same Day File and didn't mean to?

Contact the bank right away to determine what options are available, such as deletion or reversal. In addition, contact the parties for which you sent the transactions to make them aware of the situation and confirm if they will accept the transaction

Remember, by using our ACH services, you agree to comply with the Operating Rules of NACHA. You can review these rules at NACHA.org.

Thank you again for banking with us. We are grateful for your business relationship.

If you have any questions, please call us at (806) 345-1676 or 1-800-ANB-FREE (1-800-262-3733).

{endAccordion}

Travel Safety

{beginAccordion h3}

Traveling with Mobile Devices

The Internet is at our fingertips with the widespread use of Internet-enabled devices such as smart phones and tablets. When traveling and shopping anytime, and especially during the holidays, consider the wireless network you are using when you complete transactions on your device.

What are the Risks?

Your smart phone, tablet, or other device is a full-fledged computer. It is susceptible to risks inherent in online transactions. When shopping, banking, or sharing personal information online, take the same precautions with your smart phone or other device that you do with your personal computer — and then some. The mobile nature of these devices means that you should also take precautions for the physical security of your device and consider the way you are accessing the Internet.

Should I use public Wi-Fi networks?

Avoid using open Wi-Fi networks to conduct personal business, bank, or shop online. Open Wi-Fi networks at places such as airports, coffee shops, and other public locations present an opportunity for attackers to intercept sensitive information that you would provide to complete an online transaction.

If you simply must check your bank balance or make an online purchase while you are traveling, turn off your device's Wi-Fi connection and use your mobile device's cellular data Internet connection instead of making the transaction over an unsecure Wi-Fi network.

Should I turn off Bluetooth when not in use?

Yes. Bluetooth-enabled accessories can be helpful, such as earpieces for hands-free talking and external keyboards for ease of typing. When these devices are not in use, turn off the Bluetooth setting on your phone. Cyber criminals have the capability to pair with your phone's open Bluetooth connection when you are not using it and steal personal information.

Should I be careful when using public charging stations?

Yes. Avoid connecting your mobile device to any computer or charging station that you do not control, such as a charging station at an airport terminal or a shared computer at a library. Connecting a mobile device to a computer using a USB cable can allow software running on that computer to interact with the phone in ways that a user may not anticipate. As a result, a malicious computer could gain access to your sensitive data or install new software.

Should I be concern with phishing scams?

Yes. If you are in the shopping mode, an email that appears to be from a legitimate retailer might be difficult to resist. If the deal looks too good to be true, or the link in the email or attachment to the text seems suspicious, do not click on it!

What do I do if my account is compromised?

If you notice that one of your online accounts has been hacked, call the bank, store, or credit card company that owns your account. Reporting fraud in a timely manner helps minimize the impact and lessens your personal liability. You should also change your account passwords for any online services associated with your mobile device using a different computer that you control. If you are the victim of identity theft, additional information is available from https://www.idtheft.gov/.

{endAccordion}